Charts And Statistics

Major Rulemaking Proceedings that Increased Regulatory Burdens, October 2009–September 2010

October 2009

October 30, 2009, Environmental Protection Agency, “Mandatory Reporting of Greenhouse Gases”:$94.9 million annually; $140.7 million start-up.

November 2009

November 17, 2009, Federal Reserve System, “Electronic Fund Transfers”: $10.9 million annually.

December 2009

December 1, 2009, Environmental Protection Agency, “Effluent Limitations Guidelines and Standards for the Construction and Development Point Source Category”: $810.8 million annually.

December 4, 2009, Securities and Exchange Commission, “Amendments to Rules for Nationally Recognized Statistical Rating Organizations”: $34.9 million annually; $16.2 million start-up.

December 4, 2009, Department of Transportation, Pipeline and Hazardous Materials Safety Administration, “Pipeline Safety: Integrity Management Program for Gas Distribution Pipelines”: $101.1 million annually; $130.1 million start-up.

December 23, 2009, Securities and Exchange Commission, “Proxy Disclosure Enhancements”: $66.5 million annually.

January 2010

January 8, 2010, Department of Energy, “Energy Conservation Program: Energy Conservation Standards for Certain Consumer Products (Dishwashers, Dehumidifiers, Microwave Ovens, and Electric and Gas Kitchen Ranges and Ovens) and for Certain Commercial and Industrial Equipment (Commercial Clothes Washers)”: $23.4 million annually.

January 11, 2010, Securities and Exchange Commission, “Custody of Funds or Securities of Clients by Investment Advisers”: $125.1 million annually; $1.2 million start-up.

January 15, 2010, Federal Reserve System and Federal Trade Commission, “Fair Credit Reporting Risk-Based Pricing Regulations”: $252.1 million annually.

January 15, 2010, Department of Transportation, Federal Railroad Administration, “Positive Train Control Systems”: $477.4 million annually.

January 28, 2010, Department of the Treasury, Office of the Comptroller of the Currency; Federal Reserve System; Federal Deposit Insurance Corporation; Department of the Treasury, Office of Thrift Supervision, “Risk-Based Capital Guidelines; Capital Adequacy Guidelines; Capital Maintenance: Regulatory Capital; Impact of Modifications to Generally Accepted Accounting Principles; Consolidation of Asset-Backed Commercial Paper Programs; and Other Related Issues”: cost not quantified.

February 2010

February 9, 2010, Environmental Protection Agency, “Primary National Ambient Air Quality Standards for Nitrogen Dioxide”: cost not quantified.

February 17, 2010, Department of Agriculture, Agricultural Marketing Service, “National Organic Program; Access to Pasture (Livestock)”: cost not quantified.

February 22, 2010, Federal Reserve System, “Truth in Lending”: cost not quantified.

March 2010

March 3, 2010, Environmental Protection Agency, “National Emission Standards for Hazardous Air Pollutants for Reciprocating Internal Combustion Engines”: $373.4 million annually; $744.7 million start-up.

March 4, 2010, Securities and Exchange Commission, “Money Market Fund Reform”: $60.2 million annually; $86.9 million start-up.

March 9, 2010, Department of Energy, “Energy Conservation Program: Energy Conservation Standards for Small Electric Motors”: $263.9 million annually.

March 10, 2010, Securities and Exchange Commission, “Amendments to Regulation SHO”: $1.2 billion annually; $1.1 billion start-up.

March 19, 2010, Department of Health and Human Services, Food and Drug Administration, “Regulations Restricting the Sale and Distribution of Cigarettes and Smokeless Tobacco to Protect Children and Adolescents”: cost not quantified.

March 26, 2010, Environmental Protection Agency, “Regulation of Fuels and Fuel Additives: Changes to Renewable Fuel Standard Program”: $7.8 billion annually.

April 2010

April 1, 2010, Federal Reserve System, “Electronic Fund Transfers”: cost not quantified.

April 5, 2010, Department of Transportation, Federal Motor Carrier Safety Administration, “Electronic On-Board Recorders for Hours-of-Service Compliance”: $139 million annually.

April 14, 2010, Department of Health and Human Services, Food and Drug Administration, “Use of Ozone-Depleting Substances; Removal of Essential-Use Designation (Flunisolide, etc.)”: $181.9 million annually.

April 16, 2010, Department of Energy: Energy Conservation Program, “Energy Conservation Standards for Residential Water Heaters, Direct Heating Equipment, and Pool Heaters”: $1.3 billion annually.

May 2010

May 6, 2010, Environmental Protection Agency, “Lead; Amendment to the Opt-Out and Recordkeeping Provisions in the Renovation, Repair, and Painting Program”: $419.5 million annually; $552 million start-up.

May 7, 2010, Environmental Protection Agency and Department of Transportation, National Highway Traffic Safety Administration, “Light-Duty Vehicle Greenhouse Gas Emission Standards and Corporate Average Fuel Economy Standards; Final Rule”: $10.8 billion annually (2012–2016).

May 13, 2010, Department of the Treasury, Internal Revenue Service; Department of Labor, Employee Benefits Security Administration; Department of Health and Human Services, Office of the Secretary, “Interim Final Rules for Group Health Plans and Health Insurance Issuers Relating to Dependent Coverage of Children to Age 26 Under the Patient Protection and Affordable Care Act”: $11 million annually.

May 28, 2010, Department of Transportation, Federal Aviation Administration, “Automatic Dependent Surveillance—Broadcast (ADS-B) Out Performance Requirements to Support Air Traffic Control (ATC) Service”: $100 million annually.

June 2010

June 4, 2010, Federal Reserve System, “Electronic Fund Transfers”: cost not quantified.

June 17, 2010, Department of the Treasury, Internal Revenue Service; Department of Labor, Employee Benefits Security Administration; Department of Health and Human Services, “Interim Final Rules for Group Health Plans and Health Insurance Coverage Relating to Status as a Grandfathered Health Plan Under the Patient Protection and Affordable Care Act”: $25.2 million annually; $30.2 million start-up.

June 22, 2010, Environmental Protection Agency, “Primary National Ambient Air Quality Standard for Sulfur Dioxide”: $1.6 billion annually.

June 28, 2010, Department of the Treasury, Internal Revenue Service; Department of Labor, Employee Benefits Security Administration; and Department of Health and Human Services, “Patient Protection and Affordable Care Act: Preexisting Condition Exclusions, Lifetime and Annual Limits, Rescissions, and Patient Protections”: $4.8 million annually.

June 29, 2010, Federal Reserve System, “Truth in Lending”: cost not quantified.

July 2010

July 14, 2010, Securities and Exchange Commission, “Political Contributions by Certain Investment Advisers”: $85.1 million annually; $22.6 million start-up.

July 16, 2010, Department of Labor, Employee Benefits Security Administration, “Reasonable Contract or Arrangement Under Section 408(b)(2)—Fee Disclosure”: $57.7 million annually.

July 19, 2010, Department of the Treasury, Internal Revenue Service; Department of Labor, Employee Benefits Security Administration; and Department of Health and Human Services, “Interim Final Rules for Group Health Plans and Health Insurance Issuers Relating to Coverage of Preventive Services Under the Patient Protection and Affordable Care Act”: cost not quantified.

July 23, 2010, Department of the Treasury, Internal Revenue Service; Department of Labor, Employee Benefits Security Administration; and Department of Health and Human Services, “Interim Final Rules for Group Health Plans and Health Insurance Issuers Relating to Internal Claims and Appeals and External Review Processes Under the Patient Protection and Affordable Care Act”: $75.1 million annually.

July 28, 2010, Department of the Treasury, Office of the Comptroller of the Currency, “Registration of Mortgage Loan Originators”: $123.9 million annually; $283.3 million start-up.

August 2010

August 9, 2010, Department of Labor, Occupational Safety and Health Administration, “Cranes and Derricks in Construction”: $151.6 million annually.

August 12, 2010, Securities and Exchange Commission: “Amendments to Form ADV”: $20.5 million annually; $56.4 million start-up.

August 20, 2010, Environmental Protection Agency, “National Emission Standards for Hazardous Air Pollutants for Reciprocating Internal Combustion Engines”: $253 million annually.

September 2010

September 9, 2010, Environmental Protection Agency, “National Emission Standards for Hazardous Air Pollutants from the Portland Cement Manufacturing Industry and Standards of Performance for Portland Cement Plants”: $1 billion in 2013.

September 16, 2010, Securities and Exchange Commission, “Facilitating Shareholder Director Nominations”: $8 million annually

MF Global Explained

This video explains causal links between OTC derivatives, the financial crisis of 2008, Alan Greenspan, Robert Rubin, Larry Summers, Jon Corzine and MF Global.

The Fraud in the Capital Markets

I’ve been talking to a friend who is trying to recover some-as-yet-to-be-determined amount of his money from the MF Global debacle. I’ve been following the events somewhat closely myself as well, when I ran across what we both think is the most insightful analysis of what happened there. This is a full interview with Jim Pulava at financialsense.com with Ann Barnhardt, formerly of Barnhardt Capital Management: http://www.financialsense.com/contributors/2011/12/02/ann-barnhardt/interview-transcript

It’s “formerly” because she closed down her independent futures advisory practice which she had been running for six years and returned all of her clients funds, indicating that our financial markets had become so corrupt and so rigged that she could no longer advocate her clients participating in them. These were just a few of the favorite quotes from my friend from the interview transcript: Read more... dollarvigilante.

The Problem With Global Finance

The present European financial crisis seems absurdly complicated to the outside observer as well as to some inside observers. But the reality is fairly simple if you look at it the right way: Leave all ideology and economic theory aside, follow the money, and count things.In finance, we have this thing called a bond. A bond is a loan’s business end. When you own a bond, you own someone else’s debt. If this sounds like Slavery Lite, that’s because historically it was. We’re a lot nicer about things now: People who make the loans are expected to assume risk and practice due diligence, because enslaving or imprisoning debtors isn’t as fashionable as it used to be. You can force delinquent debtors to declare bankruptcy and liquidate their assets, but you can’t actually own people anymore. You can only own their bonds, at least in Europe. Read more... takimag the problem with global finance

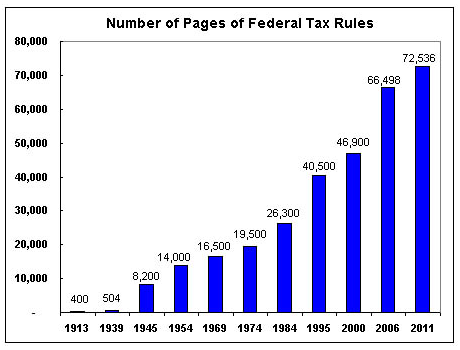

The Dems insist that they need to raise taxes. Those who don't pay their fair share are the problem... not Fedgov's obscene spending and vote buying. I wish they would look around and see how that philosophy is working out in other countries.

Welcome To Bailout 2.0!

How does printing money and giving it to people having no idea how to conserve and save their assets is going to be good for the world economy. I’m speaking of America’s Bail-Out 2.0.America, in the form of Ben Bernanke’s Traveling Money Manufacturing and Economic Shortfall Show, has taken to the road. The next stop is Europe. The Federal Reserve has decided to print almost limitless greenbacks to assist the Euro, a hemorrhaging monetary structure more noted for the fact few people understand it, than not.

The United Kingdom has a 50% Income Tax and a VAT of 17.5 % Total taxation per citizen: 67.5% Tax rate. Sweden: Income Tax 55%; VAT 25% Total: 80%. Norway: Income Tax: 54.3% Total: 79.3%. Denmark: Income Tax 58%; VAT 25% Total: 83%Even with these outrageous tax structures these countries are NOT financing social programs solely from taxes. They’re in debt beyond their eyeballs and need bail-out money no other country can really afford to provide. Except Ben Bernanke; he’ll print money until it has NO value and then print some more. Some say Bernanke needs an exorcism. He’s channeling John Maynard Keynes to no good effect.... Hat tip; woodpilereport.com Read more... thehayride.com welcome to bailout 2.0

Klavan's Economic Smackdown: Paul Ryan vs. Barack Obama

In finance, we have this thing called a bond. A bond is a loan’s business end. When you own a bond, you own someone else’s debt. If this sounds like Slavery Lite, that’s because historically it was. We’re a lot nicer about things now: People who make the loans are expected to assume risk and practice due diligence, because enslaving or imprisoning debtors isn’t as fashionable as it used to be. You can force delinquent debtors to declare bankruptcy and liquidate their assets, but you can’t actually own people anymore. You can only own their bonds, at least in Europe. Read more... takimag the problem with global finance

The Dems insist that they need to raise taxes.

Those who don't pay their fair share are the problem... not Fedgov's obscene spending and vote buying. I wish they would look around and see how that philosophy is working out in other countries. Welcome To Bailout 2.0!

How does printing money and giving it to people having no idea how to conserve and save their assets is going to be good for the world economy. I’m speaking of America’s Bail-Out 2.0.

America, in the form of Ben Bernanke’s Traveling Money Manufacturing and Economic Shortfall Show, has taken to the road. The next stop is Europe. The Federal Reserve has decided to print almost limitless greenbacks to assist the Euro, a hemorrhaging monetary structure more noted for the fact few people understand it, than not.

The United Kingdom has a 50% Income Tax and a VAT of 17.5 % Total taxation per citizen: 67.5% Tax rate. Sweden: Income Tax 55%; VAT 25% Total: 80%. Norway: Income Tax: 54.3% Total: 79.3%. Denmark: Income Tax 58%; VAT 25% Total: 83%

Even with these outrageous tax structures these countries are NOT financing social programs solely from taxes. They’re in debt beyond their eyeballs and need bail-out money no other country can really afford to provide. Except Ben Bernanke; he’ll print money until it has NO value and then print some more. Some say Bernanke needs an exorcism. He’s channeling John Maynard Keynes to no good effect.... Hat tip; woodpilereport.com Read more... thehayride.com welcome to bailout 2.0

Klavan's Economic Smackdown: Paul Ryan vs. Barack Obama

As the debt crisis threatens America, Klavan on the Culture takes a look at two competing plans.

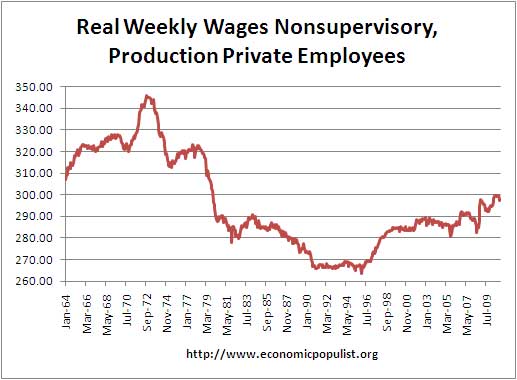

*Since Barack Obama was sworn in, the share of the national debt per household has increased by $35,835.

There's evidence all over that it may be "all over". For those who still somehow believe that our government can step in and save the day, let me leave you with a couple of unrelated (but related) humorous examples of our governments problem solving abilities.

According to data collected by the Centers for Medicare and Medicaid Services (CMS), Medicare has spent more than $240 million of taxpayer money on penis pumps for elderly men over the past decade, and will surpass a quarter of a billion dollars this year for costs since 2001.

The cost to taxpayers for the pumps more than quadrupled during that period, from a low of $11 million in 2001 to a high of more than $47 million in 2010

Consider every corny joke and personal anecdote you’ve ever heard about the United States Postal Service’s inefficiency, then savor this. In the 1960s, a stunning 83 percent of the agency’s total budget went to wages and benefits. Four decades later, after billions of dollars had been spent on automation, labor costs still account for 82 percent of the budget.... Laughing... I didn't think so...

No comments:

Post a Comment